Diving into the world of investing feels a bit like exploring a vast galaxy. Among the shining stars, ETFs (Exchange-Traded Funds) light the way for those seeking both the excitement of the market and the stability of diversified investments. One such shining star, the Invesco QQQ Trust (QQQ), has captivated many by mirroring the performance of the NASDAQ-100 Index, offering a way to invest in some of the biggest innovators in tech and beyond. Yet, as the investment universe keeps expanding, a burning question emerges: Is there another ETF that shines even brighter than QQQ?

Let’s zoom in on the “QQQ vs VGT” comparison, an intriguing face-off that draws the attention of many star-gazing investors. Vanguard’s Information Technology ETF (VGT) comes into view as a formidable contender, focusing with laser precision on the tech sector alone. This showdown isn’t just about who had the best numbers last quarter or last year; it’s about understanding each ETF’s core, their approach to the tech universe, their cost-effectiveness, and their engines for future growth. Armed with insights into QQQ and VGT, investors can navigate the vast investment cosmos more confidently.

Spotlight on QQQ: A Broader Glimpse into Innovation

Embracing the Rich Tapestry of the Market with QQQ

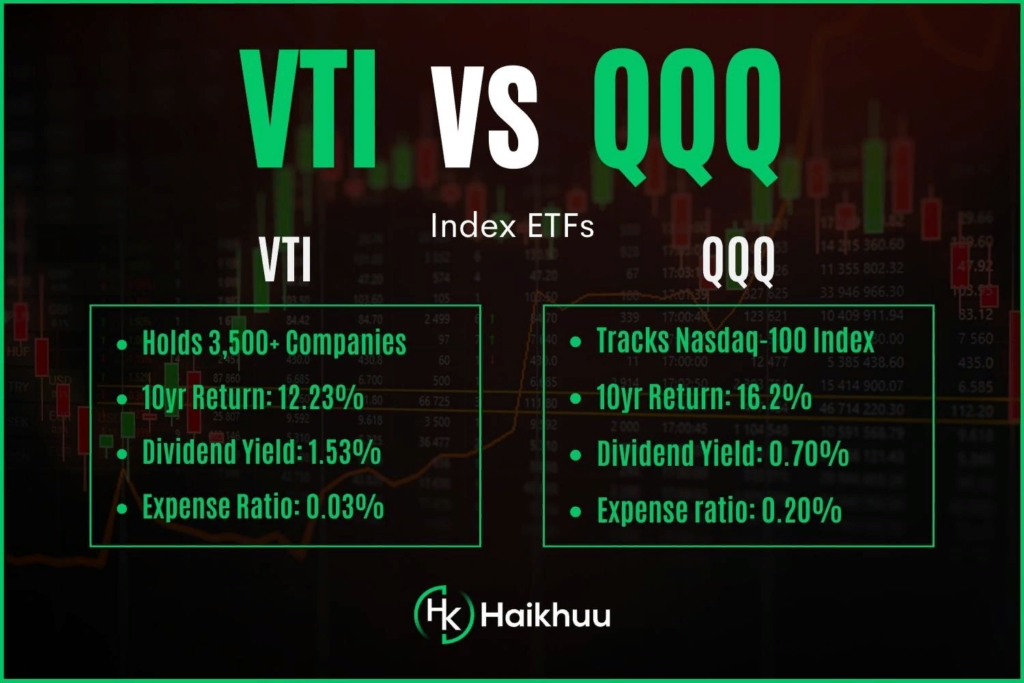

The Invesco QQQ Trust, known simply as QQQ, is akin to a master artist, employing a wide and varied palette to create a captivating market landscape. This ETF doesn’t limit itself to the bright hues of the technology sector; it also dips its brush into the rich colors of consumer services, healthcare, and more. This eclectic mix provides a robust tapestry that represents the broader market’s vibrancy and dynamism. For investors, this diversity is akin to a safety net, offering a cushion against the volatility inherent in the tech sector alone. It’s this careful blend of sectors that positions QQQ as a fortress of innovation and stability, making it an attractive option for those who seek not just growth but also a measure of safety in their investments.

The Luminous Track Record of QQQ: A Beacon for the Future

The story of QQQ’s performance is one for the ages, showcasing a journey marked by significant achievements and milestones that mirror the explosive growth and transformative power of the sectors within its fold. This ETF’s history is a tapestry woven with threads of success, marked by its adeptness at capturing the essence and momentum of market leaders and innovators. QQQ’s allure extends far beyond its historical achievements; it lies in its forward-looking nature, its ability to seize the pulse of market innovation and offer investors a gateway to participating in the growth stories that will define our future. Its portfolio, a curated collection of large-cap companies, stands as a testament to stability and growth potential, making QQQ not just a reflection of past success but a beacon for future possibilities. This unique blend of performance, innovation, and stability makes QQQ a magnetic force, drawing in investors who are eager to be part of the unfolding story of market progress and evolution.

VGT in the Telescope: Dialing Into Tech

Pure Tech, Pure Growth

When you pit “QQQ vs VGT,” VGT’s tech purity stands out. It zeroes in on the tech sector, tracking the performance of the MSCI US Investable Market Information Technology 25/50 Index. This focused approach is tantalizing for those who believe the tech sector’s growth story is just getting started, offering a concentrated dose of potential high-flyers in the tech space.

Weighing Performance Against the Price Tag

VGT’s journey has been impressive, fueled by the tech sector’s rampant growth. What makes VGT even more attractive, especially for the budget-minded investor, is its lower expense ratio compared to QQQ. This means more of your investment goes towards growing your wealth, not covering costs, a factor that could tip the scales for those leaning heavily towards tech.

More Than Just Numbers: What to Keep in Mind

The Dilemma of Diversification vs. Concentration

Choosing between QQQ and VGT involves more than just comparing returns; it’s about deciding between the safety of diversification and the thrill of concentration. QQQ offers a protective diversification, softening the blows of sector-specific downturns, while VGT’s concentrated tech focus promises higher highs but also potentially steeper lows.

Peering Into the Tech Crystal Ball

Investing wisely means looking ahead, envisioning where technology is heading, and how it will continue to weave into the fabric of every industry. With rapid advancements and the constant unveiling of new tech territories, both QQQ and VGT present paths to growth, albeit through slightly different routes.

Aligning Costs With Goals

The cost of investing is always a critical factor. VGT’s appeal includes its cost-efficiency, an important consideration in the long-term growth of your investment. However, aligning your choice with your broader investment strategy, risk tolerance, and financial goals remains key, whether you’re drawn to the diversified innovation of QQQ or the tech-centric growth potential of VGT.

Charting Your Course Through the Investment Stars

Deciding if there’s an ETF better than QQQ isn’t about finding a definitive winner. It’s about exploring the unique qualities and strategies of each fund—QQQ’s broad view of market innovation versus VGT’s focused tech lens. For those navigating the “QQQ vs VGT” debate, the decision rests on personal investment philosophies, the level of risk you’re comfortable with, and how you envision your portfolio growing.

In the vast investment universe, both QQQ and VGT offer routes to the excitement and potential of technology and innovation. By considering the aspects highlighted here, you’re better equipped to choose the ETF that not only matches your vision for the future but also complements your journey toward financial growth and stability.